do nonprofits pay taxes on interest income

Report interest income from an installment sale payment on Form 1040 US. They can start by visiting the Get Ready page on IRSgov.

Tax Free Income Personal Finance Budget Smart Passive Income Income

Here are some other things they should do to prepare to file their tax.

. COVID Tax Tip 2021-177 December 1 2021. Nonresident Alien Income Tax Return. If your taxable interest income is more than 1500 be sure to include that income on Schedule B Form 1040 Interest and Ordinary.

There are steps people including those who received stimulus payments or advance child tax credit payments can take now to make sure their tax filing experience goes smoothly in 2022. Individual Income Tax Return Form 1040-SR US. Tax Return for Seniors or Form 1040-NR US.

Unrelated Business Taxable Income For Nonprofits Sd Mayer

When You Need Your Taxes Done Right Help Is A Phone Call Away Location Does Not Matter We Prepare U S Federal Income Tax Tax Preparation Payroll Taxes

What Is The Difference Between Nonprofit And Tax Exempt Start A Non Profit Nonprofit Startup Nonprofit Marketing

What Is The Difference Between A Nonprofit And An Llc

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors Chart Of Accounts Accounting Dental Insurance

Month End Closing Checklist Aplos Academy Checklist Business Basics Educational Articles

This Perhaps Is The Most Favorite Subject Of Taxpayers And Many Of Them Already Know A Lot About It We Beli Income Tax Preparation Income Tax Tax Preparation

Tax Deduction Rules For Nonprofit Organizations Download Table

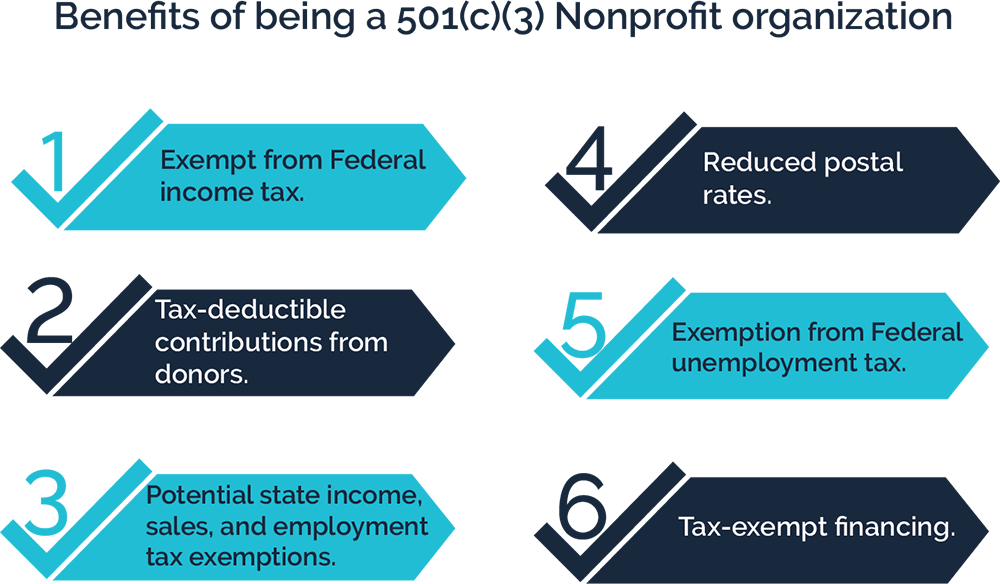

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax